Specialized Accounting for Niche Subscription Box and DTC E-commerce Brands

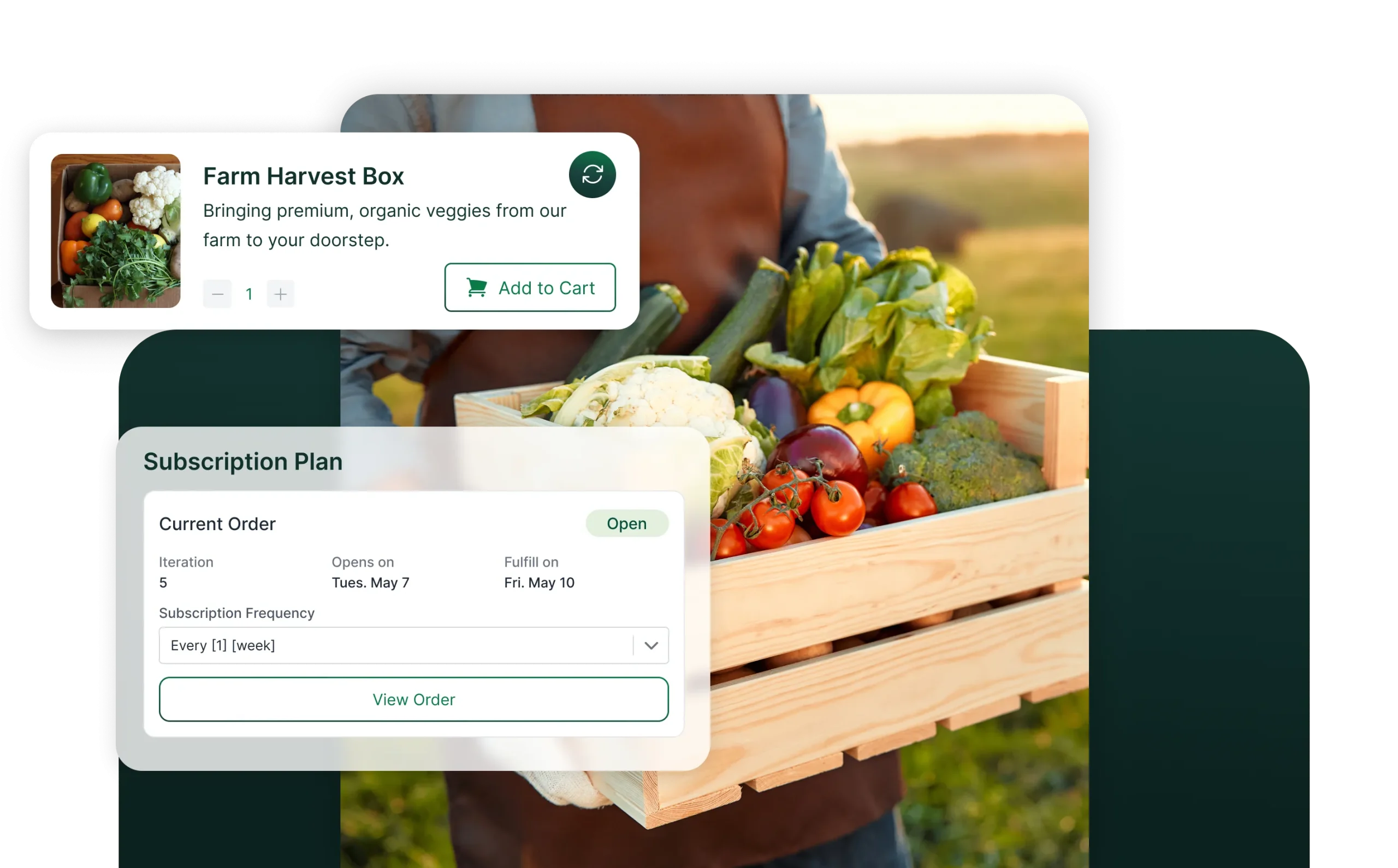

Let’s be honest. Running a subscription box or a direct-to-consumer brand is a thrilling, all-consuming ride. You’re curating experiences, building communities, and shipping joy—literally. But the back end? The spreadsheets, the revenue recognition, the inventory labyrinth? It can feel like trying to do brain surgery with the wrong tools.

That’s where specialized accounting comes in. This isn’t your grandfather’s general ledger. For niche DTC and subscription models, your finances are a living, breathing part of your product. Get them wrong, and you’re flying blind. Get them right, and you have a crystal-clear map to profitability and growth.

Why “Regular” Accounting Just Doesn’t Cut It

Think of a traditional product business. You sell a thing, you recognize the revenue, you move on. Simple. But your model? It’s a layered, recurring financial story with chapters that unfold over months.

Here’s the deal: using standard accounting software out-of-the-box is like forcing a square peg into a round hole. It might sort of fit, but you’re leaving gaps—and cash—all over the floor. The pain points are specific. Deferred revenue from annual subscriptions. Fluctuating customer lifetime value (LTV). The complex cost of goods sold (COGS) for a curated box with ten different SKUs from ten different suppliers.

The Core Financial Puzzles You Face Daily

Okay, let’s dive into the nitty-gritty. What makes the accounting for subscription box companies and DTC brands so uniquely tricky?

- Revenue Recognition (The #1 Headache): When a customer pays $120 for a yearly box, you haven’t “earned” that $120 yet. You earn it $10 at a time each month as you fulfill. That unearned cash is a liability on your books—deferred revenue. Tracking this accurately is non-negotiable for understanding true monthly performance.

- Inventory Management on Steroids: Is that lip balm in the “Summer Glow” box a separate inventory item, or part of a kit? How do you account for spoilage (for food boxes) or seasonality? Specialized accounting treats your inventory not as a cost, but as a dynamic asset that directly impacts your unit economics.

- Customer Acquisition Cost (CAC) & LTV Alignment: You know these metrics are vital. But are they woven into your actual financial statements? They should be. Seeing how your marketing spend (CAC) truly compares to the revenue a customer generates (LTV) within your accounting framework is game-changing.

- Shipping & Fulfillment Complexity: This isn’t just a line item. It’s a variable cost that changes with weight, zone, and carrier rates. For a DTC brand selling single items and subscription boxes, untangling these logistics in your books is a massive task.

Building a Financial System That Actually Scales With You

So, what does specialized accounting look like in practice? It’s proactive, not reactive. It’s built on understanding your business model’s rhythm.

| Standard Accounting Focus | Specialized DTC/Subscription Focus |

| Profit & Loss Statement | Contribution Margin per Box or per Product |

| General Inventory Value | SKU-level Profitability & Demand Forecasting |

| Total Monthly Revenue | MRR/ARR, Churn Rate, Deferred Revenue Schedules |

| Overall Marketing Spend | CAC Payback Period & Cohort Analysis |

Implementing this requires the right tools and mindset. Honestly, it often means moving beyond basic QuickBooks to integrated platforms like A2X, that seamlessly connect your Shopify or Amazon store to your books, automatically handling those complex sales tax and revenue splits.

Beyond the Numbers: Strategic Insights You Gain

When your accounting is tailored, the numbers start telling stories—not just reporting history. You can see which subscriber cohorts are most profitable (maybe those who signed up via that influencer collab have a 30% higher LTV). You can pinpoint the exact moment a new product line becomes profitable. You can model the financial impact of launching a quarterly “premium” box versus a monthly standard one.

This is where it gets exciting. This data lets you make decisions with confidence. Should you offer a lifetime discount? What’s the real cost of a “free gift” with purchase? Your specialized financial system gives you the answers, grounded in your unique economics.

Getting Started: A Realistic Roadmap

Feeling overwhelmed? Don’t be. You don’t need to overhaul everything overnight. Here’s a practical, numbered approach to move towards specialized accounting.

- Audit Your Current State: Take a hard look at your current chart of accounts. Is it a generic mess? Start by categorizing expenses in a way that mirrors your business operations (e.g., “Packaging Design,” “Influencer Gifting,” “Subscription Platform Fees”).

- Choose Your Tech Stack Wisely: Integrate your e-commerce platform, your subscription management tool (like Recharge or Cratejoy), and your accounting software. Automation is your best friend here—it reduces errors and saves countless hours.

- Master Your Key Metrics: Define, track, and review these religiously: Monthly Recurring Revenue (MRR), Churn Rate, Average Order Value (AOV), and Gross Margin per Subscription Box.

- Seek Niche Expertise: Consider hiring a fractional CFO or an accountant who has literally done this before for a DTC brand. Their experience is worth its weight in gold—they’ll anticipate pitfalls you didn’t know existed.

Look, the goal isn’t to become an accountant yourself. It’s to build a financial foundation so solid, so insightful, that it fuels your creativity instead of stifling it. When you know your numbers inside and out, you can take bigger, smarter risks. You can truly understand the value of a customer—beyond just that first sale.

In the end, specialized accounting is more than compliance. It’s the quiet engine that allows the magic of your brand—the unboxing moments, the loyal community, the next innovative product—to not just exist, but thrive sustainably. It turns your financial data from a confusing rear-view mirror into a precise GPS, guiding every decision you make on the road ahead.